capital gains tax increase 2021 uk

The higher rate threshold the Personal Allowance added to the basic rate limit will increase to 50270 for 2021 to 2022. The following Capital Gains Tax rates apply.

Capital Gains Tax What Is It When Do You Pay It

Income between 12500 and 50000 is taxed at 20 while above that each additional pound of income is taxed at 40 up to earnings of 150000 when the rate goes up.

. Households over the age of 60 gained 80000 in property on average against less than 20000 for the under-40s. For the sale of a business such as a small advice firm sole traders or. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget.

In same monthbecame resident in march 2019I invested the money in 2 properties1 my main residencedo I have to pay capital gains tax on the sale of my UK homethxs. By Charlie Bradley 0700 Thu Oct 28 2021. Chancellor can go down in history as a great reformer if he fixes the disparity with income tax in Wednesdays budget UK could gain 16bn a year if shares and.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. First things first you get a capital gains tax allowance which means for 2020-21 you dont have to pay the tax on the first 12300 of gains you make or first 6150 for trusts. This could mean a switch to 20 per cent rates for people on.

Entrepreneurs relief was slashed last. 12300-Amount on which CGT Charged. To understand why in this instance weve been charged 18 see the Capital Gains Tax bands below.

The government said in March 2021 that these rates would. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. These rates remain unchanged from the year 2021-22.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. First published on Tue 26 Oct 2021 1100 EDT The government could raise an extra 16bn a year if the low tax rates on profits from shares and property were increased and. 10 and 20 tax rates for individuals not including residential property and carried interest 18 and 28 tax rates for individuals.

Consultations on policies that will define the UKs. As announced at Budget 2021 the government will. Its the gain you make thats taxed not the amount of money you.

Although normally most tax rate changes come into effect on budget day or soon after 2021s tax reforms might need to wait. If youre a higher-rate taxpayer its 20 and 28 respectively. The Chancellor has long been rumoured be considering bringing capital gains tax rates more in line with income tax.

CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax. Capital Gains Tax CGT has been one of the levies discussed. Capital gains tax rise being considered by Rishi Sunak Chancellor again mulls increasing the tax paid on shares and company assets from its current level of 28 per.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. For the wealthiest 10 of households it was 174000 while. Basic rate taxpayers - Fall into this bracket and youll pay 10 on any gains or 18 if.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Potential Increase in Tax. First deduct the Capital Gains tax-free allowance from your taxable gain.

Add this to your taxable.

Crypto Tax Uk Ultimate Guide 2022 Koinly

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Crypto Tax Uk Ultimate Guide 2022 Koinly

Crypto Tax Uk Ultimate Guide 2022 Koinly

Difference Between Income Tax And Capital Gains Tax Difference Between

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Crypto Tax Uk Ultimate Guide 2022 Koinly

Tax Advantages For Donor Advised Funds Nptrust

The Age Of Big Data Talent Development Development Education And Training

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How Are Dividends Taxed Overview 2021 Tax Rates Examples

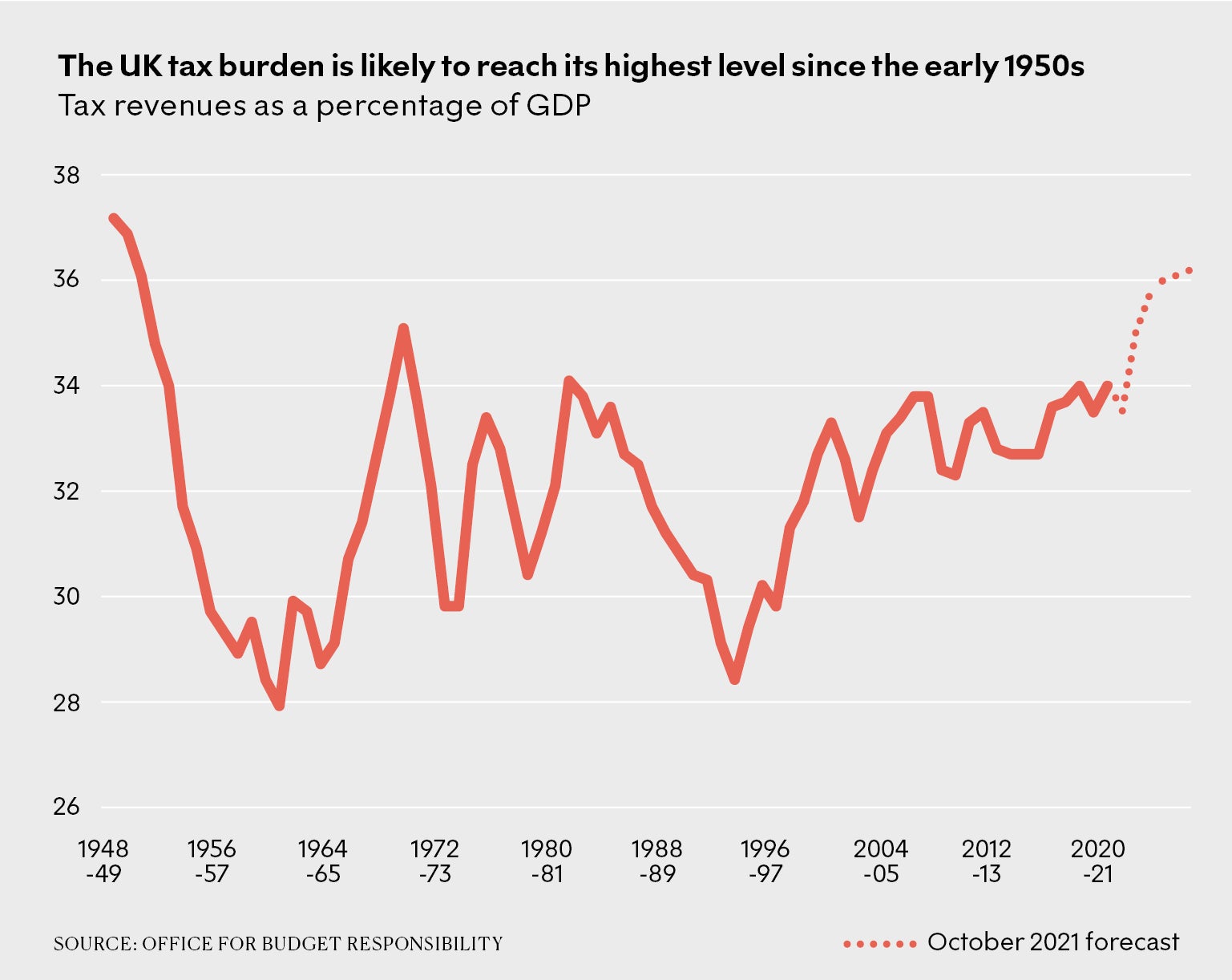

The Rise Of High Tax Britain New Statesman

Crypto Tax Uk Ultimate Guide 2022 Koinly

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

What Are Capital Gains Tax Rates In Uk Taxscouts

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options